High Income Doesn’t Guarantee a Strong Financial Outcome

For many professional couples earning strong incomes, financial progress can feel automatic. Cash flow is healthy, lifestyle costs are manageable, and retirement appears comfortably distant. Yet this sense of security can mask a more subtle risk: delay.

Busy careers and family commitments often mean that longer-term financial decisions are postponed. Investing is deferred, superannuation settings remain unchanged, and surplus income sits idle. Over time, this inertia can materially affect outcomes.

Four couples, same income, very different results

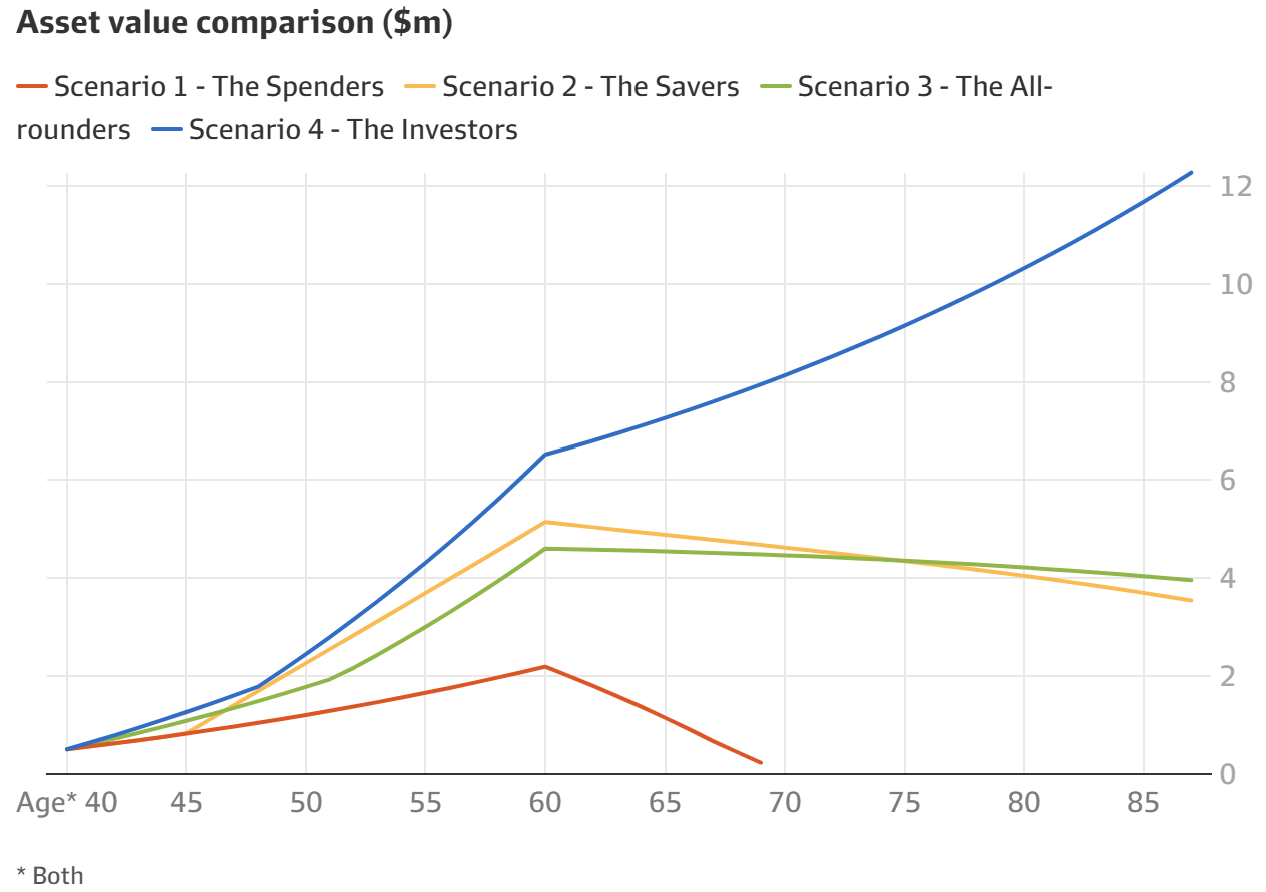

The chart compares four hypothetical couples, all aged 40, earning a combined $600,000 per year and planning to retire at age 60. Each couple starts with similar assets, similar homes, similar debt, and similar superannuation balances. What differs is how they approach spending, saving, and investing.

The Spenders prioritise lifestyle today, invest minimally, and make few strategic changes. Their wealth peaks around retirement and then declines rapidly, eventually running out.

The Savers focus on debt reduction and holding cash. While they reach retirement in a reasonable position, their long-term wealth erodes over time.

The All-rounders balance lifestyle spending with meaningful investment and exposure to growth assets. Over time, their wealth holds up better than the Savers, despite higher spending.

The Investors combine controlled spending with consistent investing. As shown in the chart, their wealth continues to grow well into retirement, driven by compounding returns.

By age 85, the difference between these approaches is stark. Despite identical starting positions and incomes, outcomes diverge by many millions of dollars.

The real cost of delay

What the chart highlights is not risk-taking or extreme frugality. It highlights the cost of waiting.

High-income earners often delay decisions because they feel complex, time-consuming, or non-urgent. But years spent out of the market are years where compounding cannot work. Once that time has passed, it cannot be recovered.

Importantly, doing nothing is still a decision. It simply tends to be one with long-term consequences.

Why advice matters

For time-poor professionals, the challenge is rarely a lack of income. It is making informed decisions early enough and structuring them properly.

Professional financial advice helps translate income into long-term outcomes by:

Clarifying goals and trade-offs

Structuring investments and superannuation appropriately

Managing risk, tax, and cash flow over time

Avoiding costly delays and behavioural blind spots

As the chart demonstrates, small differences in approach, applied consistently, can compound into very different futures.

A quiet advantage for those who act

High income creates opportunity, but it does not guarantee success. Action, structure, and informed decision-making are what ultimately shape outcomes.

The earlier those decisions are made, the more powerful they become.

At Everest Financial Advisory, we regularly see the difference that early, well-considered advice can make. For many professionals, the most valuable step is not working harder or earning more, but putting a clear strategy in place and staying engaged with it over time.